Why is GreenOps Essential for Enterprise’s ?

In the ESG Blog series so far – we’ve explored the importance of a digital partner in building a corporate ESG strategy. We showcased how cloud can be optimized through a balance of emissions and costs with GreenOps. Furthering the series, in this blog, learn how regulatory compliance demands cloud emissions reporting, and how GreenOps can help meet such compliance.

ESG Compliance – BRSR

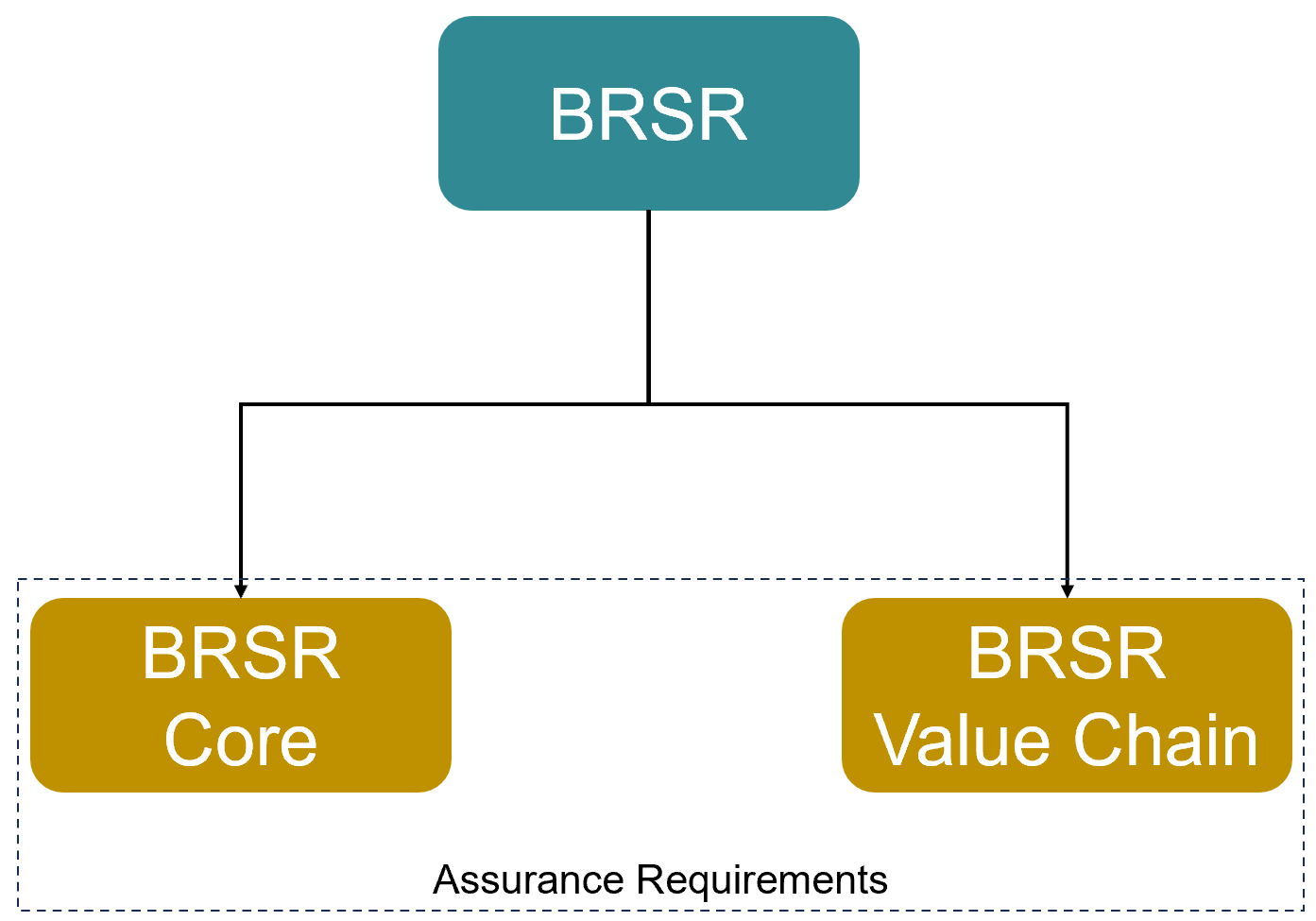

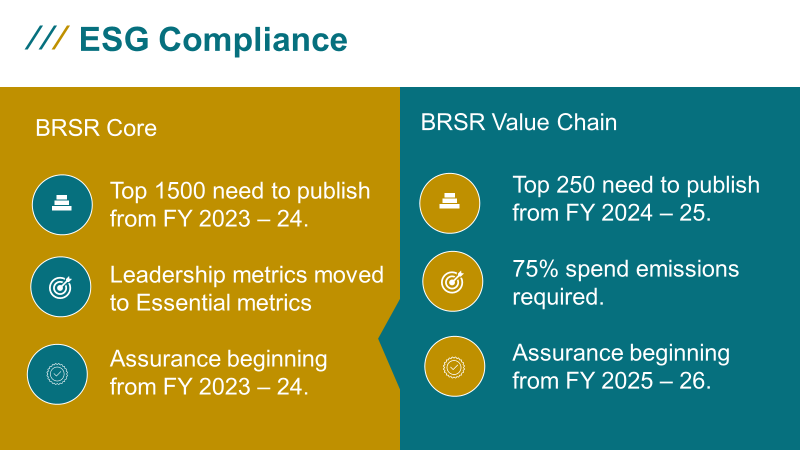

The Securities and Exchange Board of India (SEBI) in 2021 introduced an ESG reporting framework called: Business Responsibility and Sustainability Reporting (BRSR) to incentivize ESG reporting for Indian companies. The report was mandated for top 1000 companies by market capitalization beginning from FY2022-23. Following the first set of reports, in June of 2023, SEBI revised their stance on BRSR to evolve into two separate reports under the BRSR umbrella. Following below is how the report has evolved, and how it matters to your listed organization.

The BRSR split to two different reports mandated from FY 2023-24.

1. BRSR Core:

- Same as the original framework with metrics that have moved from the ‘leader’ category to ‘essential’ category increasing both – the range and depth of metrics required to report.

- The scope of mandate applies to companies increased from 1000 to 1500 ranked by market capitalization.

2. BRSR Value Chain:

- New compliance report focused on reporting scope 3 emissions across the value chain.

- Companies have to report on emissions for at least 75% spend/purchase value.

- Applies to the top 250 companies ranked by market capitalization.

3. Assurance Requirements:

- These requirements apply to each of the reports: Core and Value Chain; however, these requirements are applicable to companies in a staggered approach by market capitalization ranking.

- BRSR core will have the first issue of assurance requirements from 2023-24, and BRSR Value Chain will need to meet these requirements from 2025-26 onward.

What is Cloud Carbon?

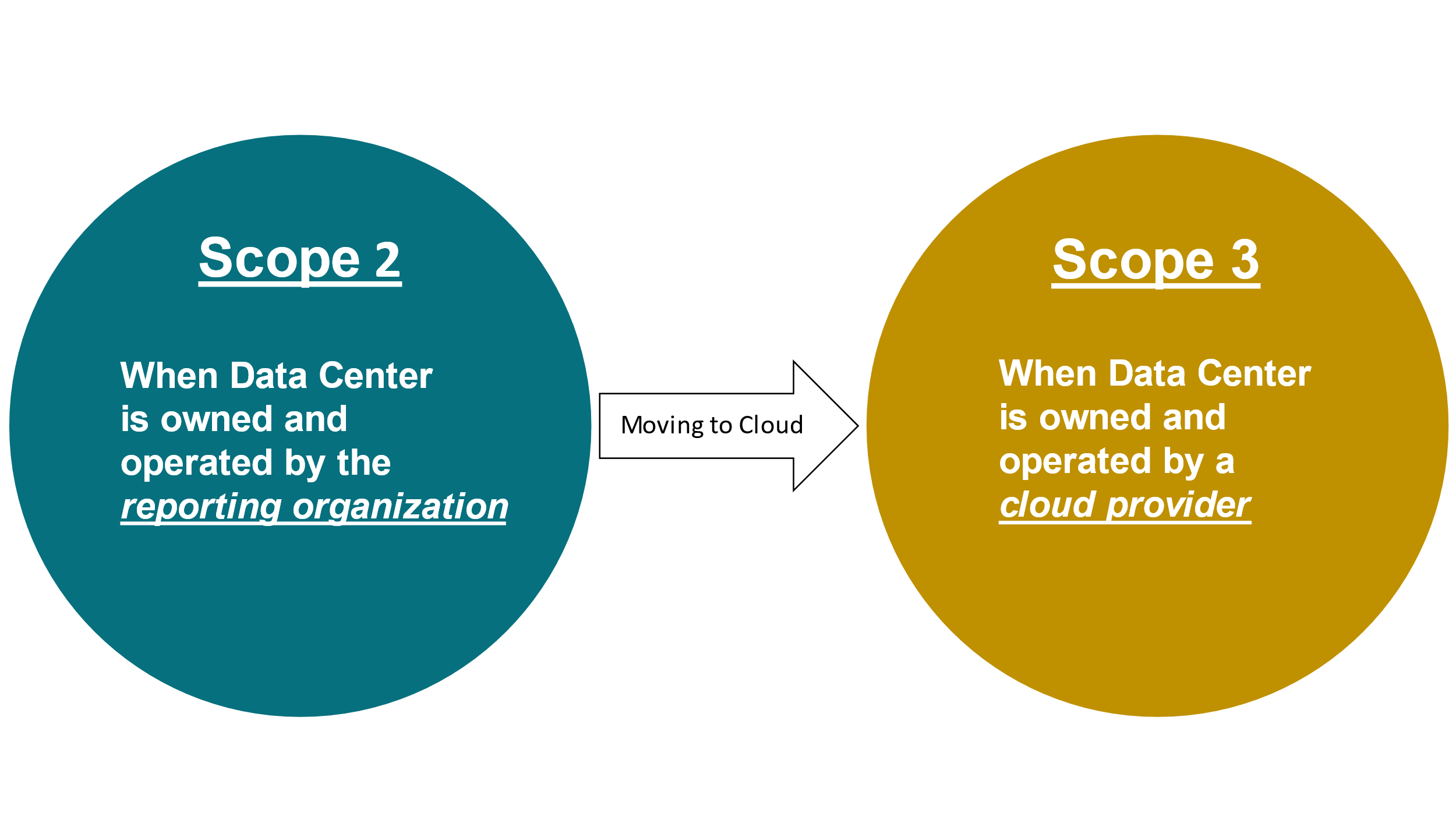

Scope 2 emissions are defined as “indirect emissions from the generation or consumption of purchased energy”. When organizations operate their own data centers – they are responsible for disclosing emissions generated as a result of running the data center; however, what happens when the data center is outsourced?

When organizations rely on hyperscale cloud providers for running their IT workloads on cloud – they essentially outsource data center management to hyperscale cloud providers like AWS. Since outsourcing – organizations no longer are directly responsible for consuming energy for their IT workloads. Instead, the responsibility of power consumption and emissions is on the hyperscale cloud provider. However, it still remains the responsibility of the organization to ensure these emissions are reflected on ESG reports under a different classification of Scope 3.

Scope 3 emissions are defined as “indirect emissions as a result of an organization’s activities outside of operational control”. Cloud emissions which are indirect emissions outside of operational control – are classified as Scope 3. Which have to be reported under Purchase of Goods/Services as part of their Upstream Scope 3 metrics.

Cloud Emission Data Problem

Hyperscale cloud providers build complex infrastructure. Operating hardware variables ranging from servers, to cooling systems, to power redundancies at such large scale inhibits the ability of cloud providers to accurately provide emission estimations for specific customer use. When paired with macroscale aspects of operating a data center – cloud providers need to weigh in power purchase agreements – which make it even more challenging to disclose such data at the risk of revealing cost structures to their competitors.

Although the 3 major cloud providers making up over 90% of the market share have rudimentary cloud emissions data for customers – they are riddled with challenges that restrict easy carbon disclosure and ESG adoption. Here are a list of challenges that are present across cloud providers.

- Bad Data: Cloud providers tend to have macro data available on their consoles. Such macro data is counter productive to an ESG strategy and cannot inform optimization strategies.

- Reduced Availability: Primary users of cloud emissions data are ESG teams. Providing secure access to only view carbon data is challenging for cloud consoles where the data lay.

- No Programmatic Access: There is no programmatic access to this data across all cloud providers. Which makes it challenging for ESG teams to continuously report this data on corporate ESG Dashboards.

- Long Time-Leads: Most cloud providers have long lead-time requirements to view emissions data which make it challenging for corporates to comply with reporting timeframes set by the government.

- Barred by Paywalls: Cloud providers provide access to this data through dashboards which are hosted behind paywalls.

GreenOps Benefit:

When customers onboard with us for GreenOps, they are assured to meet ESG compliance requirements and supercharge their IT-Sustainability plans. Cloud operational data helps us drive important insights that drive sustainable decision making. Here are some key benefits for customers when taking on GreenOps:

The BRSR Value Chain framework will undergo it’s first edition of reporting from FY 2024-25. SEBI, with careful consideration of the first iteration of this report – has set a relatively easy carbon disclosure benchmark. Corporations need to report emissions that are caused as a result of 75% of their spend and revenue. As corporates begin to report emissions across their value chain – GreenOps – as a standardized reporting solution offers a low-hanging fruit that will accelerate corporates in their race to the 75% spend emissions.

Additionally, GreenOps is built on guidance provided by the GHG Protocol, which uses spend-based emission estimation. When Assurance requirements of SEBI apply to the Value Chain report from FY 2025-26, GreenOps customers will be prepared thanks to our audit-ready data stores.

Cloud customers enjoy benefits from niche capabilities of multi-cloud environments, which increase their scope of emissions reporting. Since increase of multi-cloud dependency equates to more sources of cloud emissions. GreenOps allows multi-cloud integration across all major hyperscale cloud providers to help solve this key emissions reporting problem.

Building an IT sustainability plan with GreenOps is simple and effective. We at SHI India (Formerly Locuz) are poised to provide the best services and cloud strategy by employing a wide array of tools, resources, and expertise to ensure both, business and emissions goals are met.

Get in touch with us to explore how you can use GreenOps to go beyond meeting compliance.