ESG is starting to become central to enterprise operations, as stakeholders grow increasingly conscious of the impact of business on the planet, and people. Growing regulatory mandates, and market forces are encouraging enterprises to establish strategic ESG goals and adopt pursuant mechanisms.

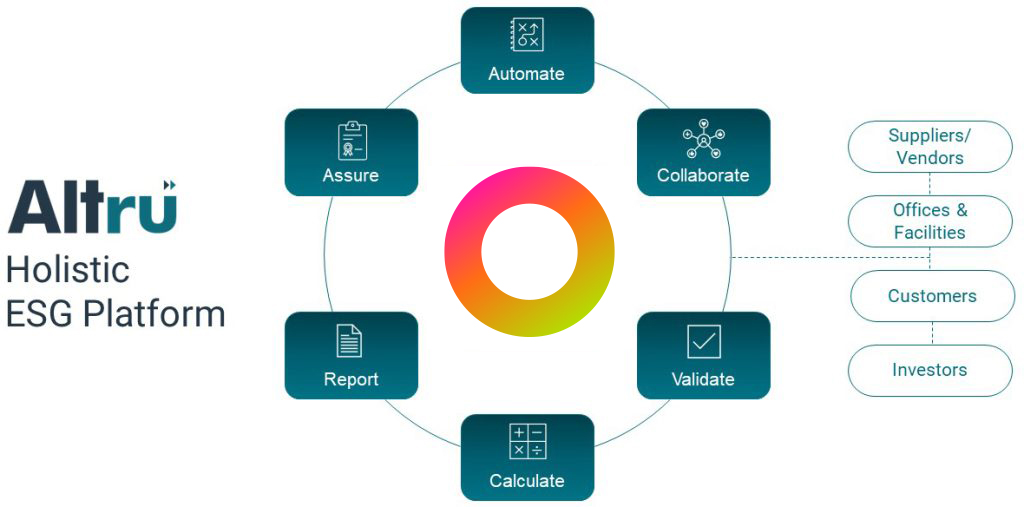

Our holistic ESG platform, paired with leading advisory services empower organizations to seamlessly manage, analyze, and report their ESG performance, driving positive impact and enhancing stakeholder trust.

Our Specialized Focus on:

GHG Emissions Management

Track and reduce GHG Emissions impact across Scope 1, 2 & 3 of your business.

Sustainability Reporting

Utilize Altru to report across a wide range of sustainability frameworks, such as BRSR, and the EU’s CSRD.

Supply Chain Sustainability

Implement a supply chain sustainability program to track and assess ESG performance of all your suppliers.

GHG Emissions Management

Track and reduce GHG Emissions impact across Scope 1, 2 & 3 of your business.

Sustainability Reporting

Utilize Altru to report across a wide range of sustainability frameworks, such as BRSR, and the EU’s CSRD.

Supply Chain Sustainability

Implement a supply chain sustainability program to track and assess ESG performance of all your suppliers.

All Sustainability in One Place

Frequently Asked Questions(FAQ)

BRSR (Business Responsibility and Sustainability Reporting) is a framework introduced by the Securities and Exchange Board of India (SEBI) in 2021 to mandate the top 1,000 listed companies in India to disclose quantifiable metrics on sustainability-related factors.

The BRSR framework aims to enhance transparency and encourage companies to adopt responsible and sustainable business practices. It requires companies to respond to questions, divided into essential indicators (mandatory) and leadership indicators (voluntary).

BRSR Core represents a subset of the BRSR, consisting of a set of Key Performance Indicators (KPIs) across 9 ESG attributes. It focuses on the Indian/emerging market context and includes some new KPIs for assurance, such as job creation in small towns, business openness, and gross wages paid to women.

It also includes intensity ratios based on revenue adjusted for Purchasing Power Parity (PPP) to facilitate better global comparability. BRSR core is increasingly mandated to more companies per year based on their market cap rankings.

Yes, the top 250 listed entities (by market capitalization) in India must provide ESG-related disclosures for their value chain partners, which collectively account for 75% of the entity’s purchases or sales, starting from FY 2024-25.

CDP (formerly the Carbon Disclosure Project) found in 2000, is a global non-profit organization that runs a disclosure system for companies, cities, states, and regions to manage their environmental impacts. It facilitates the disclosure of information related to climate change, water security, and deforestation. This enable investors, customers, and policymakers to make informed decisions.

CDP collects and scores environmental data for organizations to report their environmental performance. This data is then used to drive action towards a sustainable economy by influencing investment decisions, purchasing behaviour, and policy development. Essentially, CDP acts as a crucial link between companies and the market, promoting environmental transparency and accountability.

The International Sustainability Standards Board (ISSB) was established in 2021 by the IFRS Foundation to create a global baseline for sustainability-related financial disclosures. Its primary goal is to provide investors with high-quality, comparable information on sustainability risks and opportunities, enabling better-informed financial decisions.

Crucially, the ISSB has incorporated the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) into its standards. This integration ensures that climate-related disclosures, covering governance, strategy, risk management, and metrics & targets, are a core component of its reporting framework. By consolidating existing initiatives and frameworks, including TCFD, the ISSB aims to streamline and harmonize sustainability reporting, fostering greater transparency and accountability worldwide.

The Corporate Sustainability Reporting Directive (CSRD) is a European Union (EU) directive that aims to modernize and strengthen the rules regarding social and environmental information that companies must report. CSRD is expected to be impact a much larger set of companies ranging between 50,000 to 70,000 compared to NFRD, its previous avatar which only impacted 11,000 companies. The directive seeks to increase transparency and accountability, enabling investors and stakeholders to make more informed decisions and driving companies towards more sustainable practices within the EU.

Learn more about SHI Locuz’s ESG Reporting & Dashboarding Solutions and how we can help your organization track, analyze, and enhance its ESG performance.